You can add this rider after purchasing the policy. Long term care (LTC) rider, Pays for LTC expenditures if you meet certain criteria. Policy purchase choice, Gives you the legal right to acquire extra insurance without proof of insurability. For example, you may desire to increase your life insurance protection after the birth of a kid. Waiver of premium rider, Waives premiums if you end up being disabled or out of work. (Terms vary by insurance provider.) Similar to any type of life insurance coverage, the death advantage amount you choose at the start of your policy doesn't have actually an assigned use. With entire life, these funds usually cover funeral service costs, any staying financial obligations and provide a little inheritance.

It is necessary to note that the death advantage can be used by recipients in any method they pick. Because there's no legal requirement for them to invest it on the products that you planned, it's wise to choose your recipients carefully. You can also pick numerous recipients, allowing you to divide up the cash between member of the family the way you want. Any requirement for how the cash should be invested, such as settling a home loan or college tuition for kids or grandchildren, must be defined in a will. For many individuals, it's handy to evaluate why you require life insurance in order to make the determination between term or whole life insurance.State Farm Insurance says that whole life can be an appealing option for any of these reasons: Others are relying on you for long-lasting financial backing.

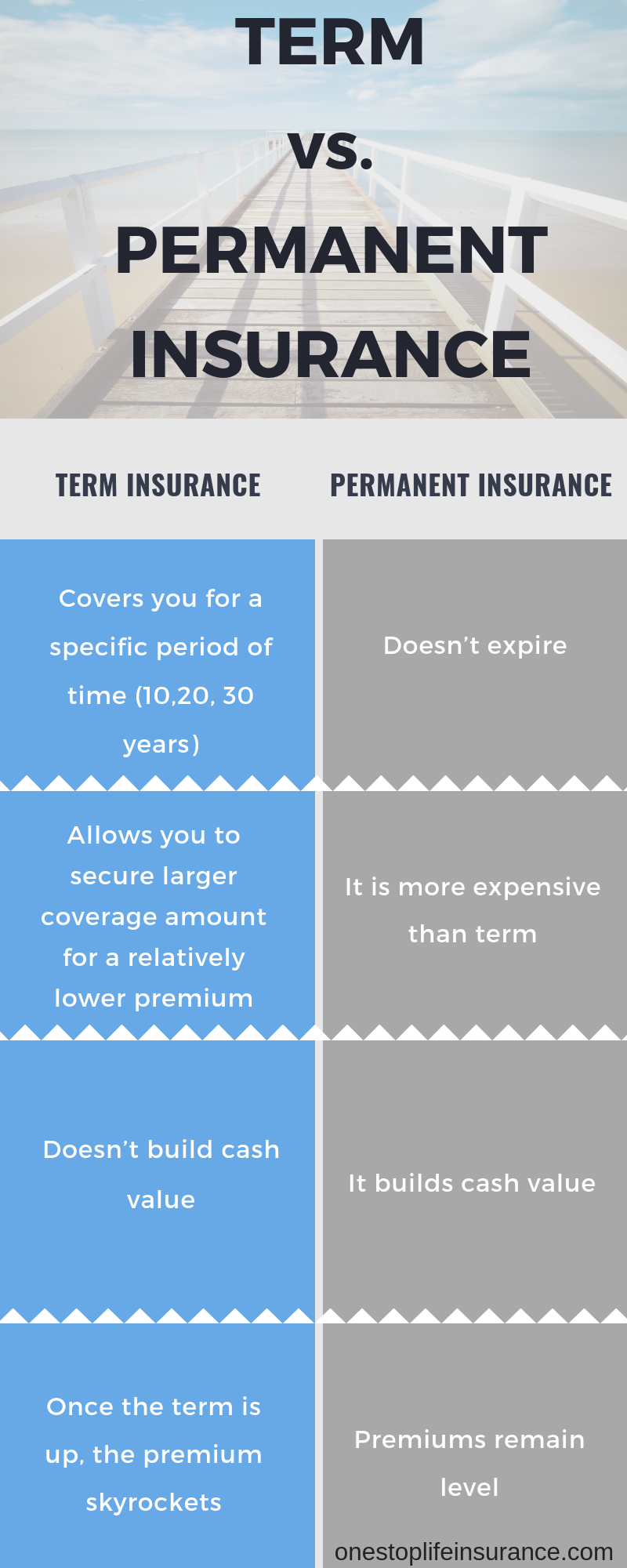

You want to develop cash value and safeguard your beneficiaries. What is liability insurance. You desire to produce an estate for your beneficiaries after your death. Your beneficiaries need the advantage to pay estate taxes when you die." Whole life does two things for you: secures your family and permits you to save for the future," says Scott Berlin, senior vice president and leader of the Group Membership Association Department at New York Life. Here's how term and entire life differ: Want a lower premium, Can manage a higher premium, Want a much shorter dedication, Want no expiration date, Will not have many expenses at theend of the term like a home loan, Want cash left to recipients, Do not care about developing cash worth, Want to build sell your timeshare scam cash value, Want a high quantity of protection, Want a reasonably conservativeinvestment accountFabric, a Brooklyn, NY-based life insurance broker says http://daltongzxy058.yousher.com/the-5-second-trick-for-how-long-can-i-stay-on-my-parents-insurance whole life insurance may be better than term life for households with lifelong dependents, families utilizing life insurance as a wealth management tool and families who wish to utilize a life insurance advantage to pay estate taxes.

The Single Strategy To Use For How Much Is A Covid Test Without Insurance

When your money worth is built up, you can access it for anything retirement, your child's college tuition or the vacation you have actually constantly desired. Whole life policies may be eligible to make dividends (depending on the company and not guaranteed). These can be utilized in a range of methods, such as supplying paid-up additional life insurance, which increases both the life insurance advantage and cash worth." Purchasing term resembles leasing your insurance," says Berlin. "You don't construct up any residual worth. Whole life resembles owning a home you develop up equity." Berlin cautions against buying term life insurance coverage simply because it's affordable life insurance coverage option." When you're 35, you think that 20 years is a long period of time, but life doesn't always work out like you believe," he says.

Later, you might be able to transform your term life policy to entire life. For the rich with large estates, putting an entire life policy into a trust is a method to avoid paying significant estate taxes when they pass away. Here prevail circumstances that you can evaluate to help identify your coverage requirement. One technique is to pick a larger term life policy during higher-debt years (e. g. mortgage, trainee loans, child expenses) and likewise purchase a smaller sized whole life policy, anticipating far less debts as you age (e. g. mortgage has been settled, kids are grown) The next step is to determine your quantity of coverage.

com has produced a Life Insurance Calculator to assist figure out a suggested protection amount. Here are the Visit website significant aspects that are considered: Funeral expenses, Outstanding financial obligation, College-bound kids, Earnings replacement, If you aren't worried about income replacement for a partner, the policy quantity might come without any commitment to your recipients. If you have no debts to pay and final funeral costs have been arranged, this is a way to leave a tax-free financial present to your beneficiaries. The quantity of the policy will be simply decided by how much you want to bequeath. A beneficiary can be a relative, however it doesn't have to be.

Indicators on What Health Insurance Should I Get You Should Know

It's not unusual for people to leave their policies to charitable organizations or a college almamater. Make sure to plainly call and notify your beneficiary. And if the recipient is a company, alert the person in charge of charitable planning/donations. Keeping the recipient a secret can produce legal issues that might hinder your desires. If you will not have any financial obligations, and you don't have a requirement for leaving a gift of money to a beneficiary, a small policy in order to cover your last funeral costs might be all you need. With just a little idea and effort, you can pre-plan your funeral and last expenditures.

If there are any funds left over, they would be offered to your secondary recipient. An entire life policy's price varies considerably depending on your age, health and habits. Due to the guaranteed payout, the premiums are substantially more than term protection. Nevertheless, do not presume that a policy runs out reach due to the fact that of expense. Eighty percent of customers misjudge the expense of term life insurance coverage, according to LIMRA. And the perceived expense avoids over 60% of millennial and Gen Xers from acquiring any life insurance coverage at all. In order to get a closer idea of what the expenses might look like, examine the entire life insurance sample premium comparison chart from AAA of Southern California.

However, the benefit related to such a policy usually passes outside of probate, suggesting no will is essential to guarantee your life insurance coverage pay out is performed to called beneficiaries. When you acquire a life insurance coverage policy, you'll be asked to submit a form that names a beneficiary. That specific or group of individuals will get the benefit of your policy after you die. No will is required to make certain the cash gets to the right place. However, noting your whole life insurance policy in your will can help liked ones understand that the policy exists and can point them in the right instructions in regards to collecting the benefit.